Thank you for your interest in our project.

Through the collection of information materials, SolarTec Inside aims at giving insight into Solar Tec’s extraordinary successful development until 7. July 2008 — more than five years after Dr Merkel’s unexplained dismissal as the company’s chairman.

In March 2008, Merrill Lynch put together a comprehensive management presentation to prepare SolarTec’s stock market launch which was sent to key investors SolarTec’s stock market value was assessed up to EUR 1.5 billion.

DOWNLOAD AS PDF

In addition, we will make a first attempt to inform about SolarTec’s subsequent downfall and its successors as well as investment companies.

The company had over 1500 investors that were directly or indirectly involved. These investors made a double digit million euro investment expecting a continued development of the company.

In 2007 and until mid 2008 they could hope for their investments to be very fruitful indeed: The documents collected prove that at this time, Merril Lynch, the leading global investment bank wanted to bring the company to the the stock exchange in Singapore with a value of over EUR 1 billion.

The continuous success of Chinese companies Trina, Yingli and Renesola which were brought to the stock exchange by Merril Lynch the previous year proves that this wasn’t a fantasy. Yingli and Trina are the world’s largest PV manufacturers for years (places 1 and 2 in 2012).

SolarTec’s positive development, illustrated in detail through documents and emails, came to an abrupt end after 7. July 2008.

The chairmen put in place by the board of directors, both of them solicitors, did not have the required industry knowledge nor access to the established network in Asia. More than anything, however, one thing was missing: the trust of the business partners! It was precisely this trust that was the deciding factor in this newly developed industry without defined structures, especially in Asia. Consequently, the most important suppliers refused to work together with the new chairmen.

Two letters from these partners give further insight and are therefore being displayed.

Moreover, they were unable to bring in new orders. The management’s activities were mainly focused on coming up with an explanation of the course of action against CEO Dr. Merkle.

There were no facts that would have justified a decision with such serious consequences.

This becomes clear by the fact that despite the prosecution’s intense investigations including a high number of searches, and the securing of hundreds of files, computers and data on several servers, the proceedings still have not been closed – even five years after Dr Merkle’s dismissal on 7. July 2008.

The alleged displacements of SolarTec’s assets were nothing but empty allegations trying to justify the course of action taken – they never took place. This is proven by neutral reports of several certified accountants. On the contrary: considerable means were given to the SolarTec AG by Bavarian Solar AG.

Only this way it was possible to keep up the liquidity required for the construction of power stations. The alleged embezzlement was therefore never mentioned by the board of directors or the previous chairmen when the charges were pressed. It would have been absurd: Dr. Merkle did not even seek a CEO’s salary. The many investors did not receive any information on the status of the proceedings, except for a brief and – from today’s perspective – false explanation from the liquidator in January 2009. Instead, the “rumour mill is buzzing”.

Under the new management, the SolarTec AG had to file for bankruptcy by the end of December 2008, i.e. only six months after Dr. Merkle’s dismissal. Dr. Merkle was also allegedly responsible for this bankruptcy. However, there is no evidence to support this allegation. On the contrary. Dr. Merkle tried through gratuitous transfer of his shares and the payment of EUR 300.000 from his outstanding accounts from the Bavarian Solar AG to enable the SolarTec AG’s comeback.

The liquidator then went on to sell the SolarTec AG’s assets in 2009 in a so-called “asset deal” to a successor company. The management, Mister O., Mister H. and Mister G. of the investment company Fonds & Vermögen (F & V) have launched a second successor company, the SolCon Tec AG. The investors of those three solarfonds were able to invest in SolCon Tec AG and did so with more, considerable amounts. Despite the boom in the solar industry in the years between 2009 and 2011, both new companies had to file for bankruptcy and not only destroyed the newly brought in investments but also considerably damaged the suppliers.

For example, the Phono Solar from Nanjing has lost – according to its own statement – EUR 1.500.000 through SolCon Tec AG’s bankruptcy. But also the investment company Fonds & Vermögen (F & V) has gone bankrupt in the meantime. All companies were registered in Munich. Many investors and previous “friends of the SolarTec AG” have asked the publishers to collect the available information. They put together an information page in order to provide the full picture – which will become more detailed through further articles.

Die SolarTec AG wurde in Dresden gegründet mit dem Ziel eine eigene Modulfertigung aufzubauen

Die SolarTec AG wurde in Dresden gegründet mit dem Ziel eine eigene Modulfertigung aufzubauen Nachdem das ursprüngliche Konzept in Dresden gescheitert war, übernahm Dr. Merkle 2005 die Unternehmensleitung und siedelte das Unternehmen in München an. Im Focus stand die Entwicklung der Konzentratortechnologie.

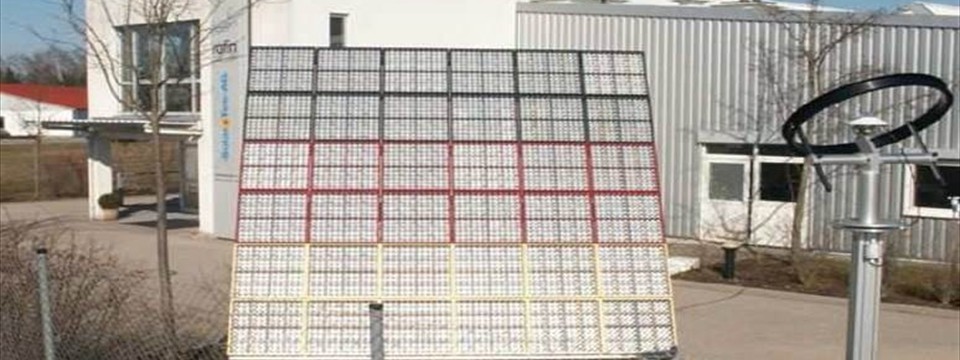

Nachdem das ursprüngliche Konzept in Dresden gescheitert war, übernahm Dr. Merkle 2005 die Unternehmensleitung und siedelte das Unternehmen in München an. Im Focus stand die Entwicklung der Konzentratortechnologie. In Aschheim bei München erzielte die SolarTec mit den neu entwickelten Konzentratormodulen, den „Weltraum-Solarzellen“ und einem selbst entwickelten Tracker hohe Wirkungsgrade.

In Aschheim bei München erzielte die SolarTec mit den neu entwickelten Konzentratormodulen, den „Weltraum-Solarzellen“ und einem selbst entwickelten Tracker hohe Wirkungsgrade.  Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte.

Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte. Die SolarTec hatte einen wissenschaftlichen Beirat u.a. mit dem bekannten Nobelpreisträger Prof. Alferov (Mitte rechts neben Dr. Merkle) der zusammen mit 8 weiteren im Bereich PV erfahrenen Professoren und Wissenschaftlern das Unternehmen beraten haben.

Die SolarTec hatte einen wissenschaftlichen Beirat u.a. mit dem bekannten Nobelpreisträger Prof. Alferov (Mitte rechts neben Dr. Merkle) der zusammen mit 8 weiteren im Bereich PV erfahrenen Professoren und Wissenschaftlern das Unternehmen beraten haben. Im Jahr 2007 ging für die SolarTec AG die Sonne auf: Die Mini-Umsätze 2006 wurden bis Ende 2007 auf 46 Mio. Euro gesteigert und ein Gewinn von über 5 Mio. Euro erzielt.

Im Jahr 2007 ging für die SolarTec AG die Sonne auf: Die Mini-Umsätze 2006 wurden bis Ende 2007 auf 46 Mio. Euro gesteigert und ein Gewinn von über 5 Mio. Euro erzielt. Das eigene Installationsteam ging beim Bau der Solarparks keine Kompromisse ein: Langlebigkeit, Sicherheit und hohe Erträge waren die Maxime

Das eigene Installationsteam ging beim Bau der Solarparks keine Kompromisse ein: Langlebigkeit, Sicherheit und hohe Erträge waren die Maxime Schon der erste Solarpark in Laudenbach mit 3,6 MWp wurde im Frühsommer 2007 von einem kleinen Team mit weniger als 10 Mitarbeitern in nur 8 Wochen installiert: Ein Rekord zum damaligen Zeitpunkt.

Schon der erste Solarpark in Laudenbach mit 3,6 MWp wurde im Frühsommer 2007 von einem kleinen Team mit weniger als 10 Mitarbeitern in nur 8 Wochen installiert: Ein Rekord zum damaligen Zeitpunkt. Bereits im Jahr 2007 gehörte die SolarTec AG zu den ersten PV Unternehmen die Solarparks mit über zehn Megawatt geplant und selbst gebaut haben

Bereits im Jahr 2007 gehörte die SolarTec AG zu den ersten PV Unternehmen die Solarparks mit über zehn Megawatt geplant und selbst gebaut haben Innerhalb von nur wenigen Monaten realisierte die SolarTec AG im Jahr 2007 fünf große Solarparks im Umfang von jeweils mehreren Megawatt

Innerhalb von nur wenigen Monaten realisierte die SolarTec AG im Jahr 2007 fünf große Solarparks im Umfang von jeweils mehreren Megawatt

Im April 2008 hatte die SolarTec eine Projektpipeline von über 100 Megawatt und für 2008 einen Umsatz über

150 Millionen geplant (Email Dr.P. mit den konkreten Planungsunterlagen).

Für 2009 war eine Umsatzsteigerung von 100% schon das Projekt Briest realistisch.

Im April 2008 hatte die SolarTec eine Projektpipeline von über 100 Megawatt und für 2008 einen Umsatz über

150 Millionen geplant (Email Dr.P. mit den konkreten Planungsunterlagen).

Für 2009 war eine Umsatzsteigerung von 100% schon das Projekt Briest realistisch. Die SolarTec AG beteiligte sich mit 25% an der Phono Solar in Nanjing. Dieses Unternehmen gehört zu den wenigen chinesischen PV Produzenten die auch heute noch sehr erfolgreich und ertragreich arbeiten. Nach dem 7.7.2008 kündigte die Phono Solar die Beteiligung da sie kein Vertrauen in die neue Geschäftsleitung hatte (Schreiben des CEO der Phono Solar Cai Jibao).

Die SolarTec AG beteiligte sich mit 25% an der Phono Solar in Nanjing. Dieses Unternehmen gehört zu den wenigen chinesischen PV Produzenten die auch heute noch sehr erfolgreich und ertragreich arbeiten. Nach dem 7.7.2008 kündigte die Phono Solar die Beteiligung da sie kein Vertrauen in die neue Geschäftsleitung hatte (Schreiben des CEO der Phono Solar Cai Jibao). Die Solarparks der SolarTec AG erbrachten aufgrund der Qualität der verwendeten Komponenten überdurchschnittliche Erträge

Die Solarparks der SolarTec AG erbrachten aufgrund der Qualität der verwendeten Komponenten überdurchschnittliche Erträge In der Finanzmetropole Hongkong bemühten sich die weltweit führenden Investmentbanken Credit Suisse, Merrill Lynch, HSBC sowie weitere intensiv um die Begleitung des Börsengangs der SolarTec AG

In der Finanzmetropole Hongkong bemühten sich die weltweit führenden Investmentbanken Credit Suisse, Merrill Lynch, HSBC sowie weitere intensiv um die Begleitung des Börsengangs der SolarTec AG Die quirlige Finanzmetropole Singapur war fasziniert von den Entwicklungschancen der SolarTec AG insbesondere im asiatischen Raum. Merrill Lynch taxierte den Börsenwert auf 1,0 bis 1.5 Milliarden Euro

Die quirlige Finanzmetropole Singapur war fasziniert von den Entwicklungschancen der SolarTec AG insbesondere im asiatischen Raum. Merrill Lynch taxierte den Börsenwert auf 1,0 bis 1.5 Milliarden Euro Der erste Börsengang eines deutschen Unternehmens in Singapur wäre eine Sensation geworden. Bereits im Vorfeld haben die Medien (Finanzzeitschriften, Fernsehen und das asiatische Bloomberg TV) laufend begeistert darüber berichtet

Der erste Börsengang eines deutschen Unternehmens in Singapur wäre eine Sensation geworden. Bereits im Vorfeld haben die Medien (Finanzzeitschriften, Fernsehen und das asiatische Bloomberg TV) laufend begeistert darüber berichtet

Anfang 2008 setzte ein „wahrer Run auf die Aktien der SolarTec AG ein“ (Email Dr. P.). Diese wurden an internationale Investoren aus Asien und den USA auf der Grundlage eines Unternehmenswertes der SolarTec AG von 360 Mio. Euro verkauft

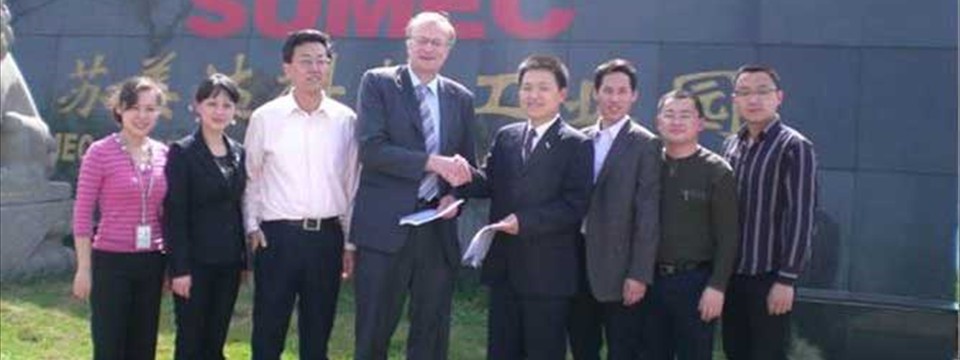

Anfang 2008 setzte ein „wahrer Run auf die Aktien der SolarTec AG ein“ (Email Dr. P.). Diese wurden an internationale Investoren aus Asien und den USA auf der Grundlage eines Unternehmenswertes der SolarTec AG von 360 Mio. Euro verkauft Am 25.4.2008 gründete die SolarTec AG zusammen mit der SUMEC-Gruppe die Phono Solar in Nanjing. Das Foto wurde nach der Unterzeichnung der Dokumente vor dem Fertigungsgebäude für SolarTec Solarmodule aufgenommen (Dr. Merkle schüttelt die Hand von Herrn Cai Jibao, dem CEO)

Am 25.4.2008 gründete die SolarTec AG zusammen mit der SUMEC-Gruppe die Phono Solar in Nanjing. Das Foto wurde nach der Unterzeichnung der Dokumente vor dem Fertigungsgebäude für SolarTec Solarmodule aufgenommen (Dr. Merkle schüttelt die Hand von Herrn Cai Jibao, dem CEO) Auf ca. 4.6 mill. m² Fläche des früheren russischen Militärflugplatzes sollte 2009 das weltgrößte PV Kraftwerk „Briest“ gebaut werden.

Die Gesamtleistung war mit 80-120 MWp geplant, der Umsatz für die Solartec hätte ca. 300 Mio. € betragen.

Nach dem 7.7.2008 wurden die Pläne gestoppt und das Grundstück später an die Q-cells verkauft die das Projekt 2010 gebaut haben.

Auf ca. 4.6 mill. m² Fläche des früheren russischen Militärflugplatzes sollte 2009 das weltgrößte PV Kraftwerk „Briest“ gebaut werden.

Die Gesamtleistung war mit 80-120 MWp geplant, der Umsatz für die Solartec hätte ca. 300 Mio. € betragen.

Nach dem 7.7.2008 wurden die Pläne gestoppt und das Grundstück später an die Q-cells verkauft die das Projekt 2010 gebaut haben. Als erstes deutsches Unternehmen gründete die SolarTec AG schon 2007 ein eigenes Unternehmen in China zur Durchführung

einer strikten Qualitätssicherung der eingesetzten Komponenten schon während des Produktionsprozesses

Als erstes deutsches Unternehmen gründete die SolarTec AG schon 2007 ein eigenes Unternehmen in China zur Durchführung

einer strikten Qualitätssicherung der eingesetzten Komponenten schon während des Produktionsprozesses Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte.

Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte.

Der Tod der SolarTec AG kam am 21.12. 2008, knapp 6 Monate nach der Entlassung von Dr. Merkle. Die Vorstände (2 Juristen) hatten keine neuen Aufträge erhalten und Umsätze erzielt. Die im Juli 2008 noch vorhandenen hohen liquiden Mittel wurden verbraucht, zu einem großen Teil für Beraterhonorare und Rechtsberatung.

Der Tod der SolarTec AG kam am 21.12. 2008, knapp 6 Monate nach der Entlassung von Dr. Merkle. Die Vorstände (2 Juristen) hatten keine neuen Aufträge erhalten und Umsätze erzielt. Die im Juli 2008 noch vorhandenen hohen liquiden Mittel wurden verbraucht, zu einem großen Teil für Beraterhonorare und Rechtsberatung.