Summary of SolarTec AG’s chronology

2002-2004

SolarTec AG was founded in Dresden at the end of 2002 with the aim to establish its own module production. The company used up the paid-in capital under chairman N.M.

2005

After the original concept failed in Dresden, chairman of supervisory board, Dr. Merkle asked to take over management of the company and to move it to Munich. Dr. Merkle reorganised the company.

The new focus was on the development of solar concentrator technology.

SolarTec AG therefore established a development division in the technology park at the Frankfurter Ring in Munich. The capital used was increased by new investments to EUR 1 million.

2006

At the beginning of 2006, the company also reached financial breakthrough.

The Munich based F & V investment company signed a contract taking over first 20% and later 25% of SolarTec AG’s shares on the basis the business evaluation being on average EUR 75 million. The equity capital was placed by several investment companies through a total of 1,500 investors.

The investment company’s first payments were used to take over ENE in Brussels, a high tech company successful in the area of production of space solar cells and one of the oldest PV companies in Europe. The company moved to a new commercial unit in Aschheim outside of Munich. There, SolarTec achieved with its newly developed concentrator modules, ENE’s high performance cells (efficiency of over 36 per cent) and its self-developed tracker high efficiencies.

SolarTec established a scientific advisory board, including nobel prize laureate Professor Alferov who advised the company together with eight other professors and scientists, each very experienced in the area of PV.

SolarTec already opened a subsidiary in Shanghai at the beginning of 2006 which flourished and took over all business operations in Asia.

2007

Due to the payments of the investment company, the capital was increased step by step to EUR 6.70 Million by the end of 2007.

By 2007, SolarTec AG was among the first PV companies that planned and constructed solar parks producing over ten megawatts. The solar park in Laudenbach with over 3.6 MWp was installed in early Summer 2007 by a small team of less than 10 people in only six weeks – a record at the time.

SolarTec AG applied the highest performing components, e.g. central inverter modules from Siemens that at this time has the highest efficiency as well as an elaborate steering and control system.

2008

At the beginning of 2008, a “true run to SolarTec AG’s shares” took place (see email Dr. P.). These were sold to international investors from Asia and the US on the basis of an evaluation of SolarTec AG of EUR 360 million.

The lively financial metropolis Singapore was fascinated by SolarTec AG’s development potential, especially in Asia. Merrill Lynch evaluated the market value at EUR 1.0 to 1.5 billion.

In the financial capital Hong Kong, investment banks Credit Suisse, Merrill Lynch, HSBC and others tried hard to partner with SolarTec AG for their stock exchange launch. Finally, the decision was made in favour of Singapore.

The first stock exchange launch of a German company in Singapore would have been a sensation. The media (financial newspapers, TV and the Asian Bloomberg TV) enthusiastically covered the story during the run up .

Despite the financial crisis which started already by the end of 2007 (Merril Lynch was one of the first the companies that were immensely affected and had to be rescued) the plan to launch at the stock exchange was not compromised.

Large investment companies such as Apollo initially assured their interest in their involvment. Only in the 2. quarter of 2008 difficulties started to emerge. SolarTec AG’s operational activity, however, still continued to develop positively.

Because of its own production line in the investment company Phono Solar, Solar Tec AG was able to meet the highest quality expectations. The solar parks owned by Solar Tec AG yielded above average returns due to high quality.

It was planned to build the world’s largest PV power station on an area of 4.6 million m² on the former military airport in Briest, Brandenburg. This should have been built in 2009.

The overall operating performance was planned to be 80 – 100 MWp, the turnover for Solar Tec would have been around EUR 300 million.

After July 2008 plans were stopped and the premises was later sold to the Q-Cells AG which realised the project with 91 MWp.

On 7. July 2008 Solar Tec AG’s success story came to an abrupt end through the dismissal of principal shareholder and chairman Dr. Erich Merkle. The raised accusations have still not been confirmed – neither were they proceeded civilly. .

Only a few weeks after Dr. Merkle’s dismissal difficulties in the company management became clear. SolarTec AG’s new chairmen were unable to get new orders in and to increase sales.

At the beginning of October, the Bavarian Solar AG tried together with Dr. Merkle to avoid bankruptcy through gratuitous transfer of SolarTec AG’s shares and the payment of EUR 300.000 from fresh assets.

The shares were sold afterwards to investors which generated more than a million worth of extra capital for the company. Without orders and sales, however, these efforts were in vain.

In a final, desperate attempt, SolarTec AG’s chairmen Dr. K. and Markus S. offered the application for new shares until 23. December 2008. Only 9 days later, at 21. December 2008 the chairmen filed for bankruptcy.

Even though the critical state of SolarTec AG was pointed out in the letter, this offer to apply new shares could be seen as attempted investment fraud according to legal practice — because the investors could not have received back the invested amounts as these would have been attributed to the bankruptcy estate.

As illustrated above and confirmed by the financial figures, bankruptcy could have been predicted over a period of time. Potential applicants for shares would have lost their capital contribution completely (see download for offer of application) The final downfall of SolarTec AG took place on 22. December 2008, just about six months after Dr. Merkle’s dismissal. The chairmen (2 solicitors) did not manage to get in new orders or sales. .

Mr S., chief financial officer as of the end of August 08, was also unable to turn the situation around.

Chairman Dr. L. parted from the company only a few weeks before bankruptcy was filed on 10. November 2008. Considerable liquid assets which were still available in July 2008 were used up for consultancy fees and legal advice.

That SolarTec AG still had solid substance at the time where bankruptcy was filed is confirmed by an excess of approx. EUR 7 million which was disclosed in the liquidator’s report of February 2009. SolarTec belongs to only a few PV companies whose bankruptcy did not end up in a huge mountain of debt.

2012

In February 2012, the SolConTec International AG requested to open preliminary insolvency proceedings of its assets.

After SolarTec AG’s bankruptcy, SolConTec Holding AG, whose shares were held by Solarfonds 1, 2 and 3, was founded in addition to SolConTec International AG in order to continue tradings.

In March, final insolvency proceedings over the assets of Fonds & Vermögen Dienstleistungs GmbH were opened. On 12. December 2012, final insolvency proceedings of the assets of SolconTec International (AZ: 1502 I N 3040/12) were opened through the magistrate’s court in Munich. The company was taken off the commercial register.

Die SolarTec AG wurde in Dresden gegründet mit dem Ziel eine eigene Modulfertigung aufzubauen

Die SolarTec AG wurde in Dresden gegründet mit dem Ziel eine eigene Modulfertigung aufzubauen Nachdem das ursprüngliche Konzept in Dresden gescheitert war, übernahm Dr. Merkle 2005 die Unternehmensleitung und siedelte das Unternehmen in München an. Im Focus stand die Entwicklung der Konzentratortechnologie.

Nachdem das ursprüngliche Konzept in Dresden gescheitert war, übernahm Dr. Merkle 2005 die Unternehmensleitung und siedelte das Unternehmen in München an. Im Focus stand die Entwicklung der Konzentratortechnologie. In Aschheim bei München erzielte die SolarTec mit den neu entwickelten Konzentratormodulen, den „Weltraum-Solarzellen“ und einem selbst entwickelten Tracker hohe Wirkungsgrade.

In Aschheim bei München erzielte die SolarTec mit den neu entwickelten Konzentratormodulen, den „Weltraum-Solarzellen“ und einem selbst entwickelten Tracker hohe Wirkungsgrade.  Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte.

Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte. Die SolarTec hatte einen wissenschaftlichen Beirat u.a. mit dem bekannten Nobelpreisträger Prof. Alferov (Mitte rechts neben Dr. Merkle) der zusammen mit 8 weiteren im Bereich PV erfahrenen Professoren und Wissenschaftlern das Unternehmen beraten haben.

Die SolarTec hatte einen wissenschaftlichen Beirat u.a. mit dem bekannten Nobelpreisträger Prof. Alferov (Mitte rechts neben Dr. Merkle) der zusammen mit 8 weiteren im Bereich PV erfahrenen Professoren und Wissenschaftlern das Unternehmen beraten haben. Im Jahr 2007 ging für die SolarTec AG die Sonne auf: Die Mini-Umsätze 2006 wurden bis Ende 2007 auf 46 Mio. Euro gesteigert und ein Gewinn von über 5 Mio. Euro erzielt.

Im Jahr 2007 ging für die SolarTec AG die Sonne auf: Die Mini-Umsätze 2006 wurden bis Ende 2007 auf 46 Mio. Euro gesteigert und ein Gewinn von über 5 Mio. Euro erzielt. Das eigene Installationsteam ging beim Bau der Solarparks keine Kompromisse ein: Langlebigkeit, Sicherheit und hohe Erträge waren die Maxime

Das eigene Installationsteam ging beim Bau der Solarparks keine Kompromisse ein: Langlebigkeit, Sicherheit und hohe Erträge waren die Maxime Schon der erste Solarpark in Laudenbach mit 3,6 MWp wurde im Frühsommer 2007 von einem kleinen Team mit weniger als 10 Mitarbeitern in nur 8 Wochen installiert: Ein Rekord zum damaligen Zeitpunkt.

Schon der erste Solarpark in Laudenbach mit 3,6 MWp wurde im Frühsommer 2007 von einem kleinen Team mit weniger als 10 Mitarbeitern in nur 8 Wochen installiert: Ein Rekord zum damaligen Zeitpunkt. Bereits im Jahr 2007 gehörte die SolarTec AG zu den ersten PV Unternehmen die Solarparks mit über zehn Megawatt geplant und selbst gebaut haben

Bereits im Jahr 2007 gehörte die SolarTec AG zu den ersten PV Unternehmen die Solarparks mit über zehn Megawatt geplant und selbst gebaut haben Innerhalb von nur wenigen Monaten realisierte die SolarTec AG im Jahr 2007 fünf große Solarparks im Umfang von jeweils mehreren Megawatt

Innerhalb von nur wenigen Monaten realisierte die SolarTec AG im Jahr 2007 fünf große Solarparks im Umfang von jeweils mehreren Megawatt

Im April 2008 hatte die SolarTec eine Projektpipeline von über 100 Megawatt und für 2008 einen Umsatz über

150 Millionen geplant (Email Dr.P. mit den konkreten Planungsunterlagen).

Für 2009 war eine Umsatzsteigerung von 100% schon das Projekt Briest realistisch.

Im April 2008 hatte die SolarTec eine Projektpipeline von über 100 Megawatt und für 2008 einen Umsatz über

150 Millionen geplant (Email Dr.P. mit den konkreten Planungsunterlagen).

Für 2009 war eine Umsatzsteigerung von 100% schon das Projekt Briest realistisch. Die SolarTec AG beteiligte sich mit 25% an der Phono Solar in Nanjing. Dieses Unternehmen gehört zu den wenigen chinesischen PV Produzenten die auch heute noch sehr erfolgreich und ertragreich arbeiten. Nach dem 7.7.2008 kündigte die Phono Solar die Beteiligung da sie kein Vertrauen in die neue Geschäftsleitung hatte (Schreiben des CEO der Phono Solar Cai Jibao).

Die SolarTec AG beteiligte sich mit 25% an der Phono Solar in Nanjing. Dieses Unternehmen gehört zu den wenigen chinesischen PV Produzenten die auch heute noch sehr erfolgreich und ertragreich arbeiten. Nach dem 7.7.2008 kündigte die Phono Solar die Beteiligung da sie kein Vertrauen in die neue Geschäftsleitung hatte (Schreiben des CEO der Phono Solar Cai Jibao). Die Solarparks der SolarTec AG erbrachten aufgrund der Qualität der verwendeten Komponenten überdurchschnittliche Erträge

Die Solarparks der SolarTec AG erbrachten aufgrund der Qualität der verwendeten Komponenten überdurchschnittliche Erträge In der Finanzmetropole Hongkong bemühten sich die weltweit führenden Investmentbanken Credit Suisse, Merrill Lynch, HSBC sowie weitere intensiv um die Begleitung des Börsengangs der SolarTec AG

In der Finanzmetropole Hongkong bemühten sich die weltweit führenden Investmentbanken Credit Suisse, Merrill Lynch, HSBC sowie weitere intensiv um die Begleitung des Börsengangs der SolarTec AG Die quirlige Finanzmetropole Singapur war fasziniert von den Entwicklungschancen der SolarTec AG insbesondere im asiatischen Raum. Merrill Lynch taxierte den Börsenwert auf 1,0 bis 1.5 Milliarden Euro

Die quirlige Finanzmetropole Singapur war fasziniert von den Entwicklungschancen der SolarTec AG insbesondere im asiatischen Raum. Merrill Lynch taxierte den Börsenwert auf 1,0 bis 1.5 Milliarden Euro Der erste Börsengang eines deutschen Unternehmens in Singapur wäre eine Sensation geworden. Bereits im Vorfeld haben die Medien (Finanzzeitschriften, Fernsehen und das asiatische Bloomberg TV) laufend begeistert darüber berichtet

Der erste Börsengang eines deutschen Unternehmens in Singapur wäre eine Sensation geworden. Bereits im Vorfeld haben die Medien (Finanzzeitschriften, Fernsehen und das asiatische Bloomberg TV) laufend begeistert darüber berichtet

Anfang 2008 setzte ein „wahrer Run auf die Aktien der SolarTec AG ein“ (Email Dr. P.). Diese wurden an internationale Investoren aus Asien und den USA auf der Grundlage eines Unternehmenswertes der SolarTec AG von 360 Mio. Euro verkauft

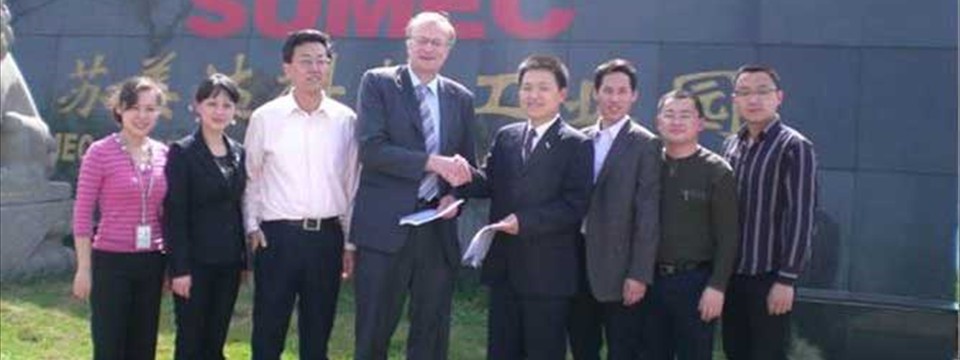

Anfang 2008 setzte ein „wahrer Run auf die Aktien der SolarTec AG ein“ (Email Dr. P.). Diese wurden an internationale Investoren aus Asien und den USA auf der Grundlage eines Unternehmenswertes der SolarTec AG von 360 Mio. Euro verkauft Am 25.4.2008 gründete die SolarTec AG zusammen mit der SUMEC-Gruppe die Phono Solar in Nanjing. Das Foto wurde nach der Unterzeichnung der Dokumente vor dem Fertigungsgebäude für SolarTec Solarmodule aufgenommen (Dr. Merkle schüttelt die Hand von Herrn Cai Jibao, dem CEO)

Am 25.4.2008 gründete die SolarTec AG zusammen mit der SUMEC-Gruppe die Phono Solar in Nanjing. Das Foto wurde nach der Unterzeichnung der Dokumente vor dem Fertigungsgebäude für SolarTec Solarmodule aufgenommen (Dr. Merkle schüttelt die Hand von Herrn Cai Jibao, dem CEO) Auf ca. 4.6 mill. m² Fläche des früheren russischen Militärflugplatzes sollte 2009 das weltgrößte PV Kraftwerk „Briest“ gebaut werden.

Die Gesamtleistung war mit 80-120 MWp geplant, der Umsatz für die Solartec hätte ca. 300 Mio. € betragen.

Nach dem 7.7.2008 wurden die Pläne gestoppt und das Grundstück später an die Q-cells verkauft die das Projekt 2010 gebaut haben.

Auf ca. 4.6 mill. m² Fläche des früheren russischen Militärflugplatzes sollte 2009 das weltgrößte PV Kraftwerk „Briest“ gebaut werden.

Die Gesamtleistung war mit 80-120 MWp geplant, der Umsatz für die Solartec hätte ca. 300 Mio. € betragen.

Nach dem 7.7.2008 wurden die Pläne gestoppt und das Grundstück später an die Q-cells verkauft die das Projekt 2010 gebaut haben. Als erstes deutsches Unternehmen gründete die SolarTec AG schon 2007 ein eigenes Unternehmen in China zur Durchführung

einer strikten Qualitätssicherung der eingesetzten Komponenten schon während des Produktionsprozesses

Als erstes deutsches Unternehmen gründete die SolarTec AG schon 2007 ein eigenes Unternehmen in China zur Durchführung

einer strikten Qualitätssicherung der eingesetzten Komponenten schon während des Produktionsprozesses Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte.

Die SolarTec eröffnete bereits Anfang 2006 eine Niederlassung in Shanghai die sich sehr erfolgreich entwickelte und den ganzen asiatischen Geschäftsverkehr abwickelte.

Der Tod der SolarTec AG kam am 21.12. 2008, knapp 6 Monate nach der Entlassung von Dr. Merkle. Die Vorstände (2 Juristen) hatten keine neuen Aufträge erhalten und Umsätze erzielt. Die im Juli 2008 noch vorhandenen hohen liquiden Mittel wurden verbraucht, zu einem großen Teil für Beraterhonorare und Rechtsberatung.

Der Tod der SolarTec AG kam am 21.12. 2008, knapp 6 Monate nach der Entlassung von Dr. Merkle. Die Vorstände (2 Juristen) hatten keine neuen Aufträge erhalten und Umsätze erzielt. Die im Juli 2008 noch vorhandenen hohen liquiden Mittel wurden verbraucht, zu einem großen Teil für Beraterhonorare und Rechtsberatung.